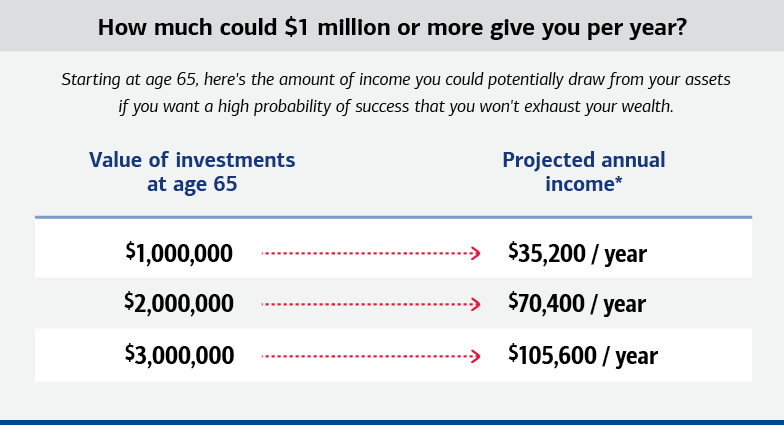

1 Merrill, Chief Investment Office, “Determining sustainable retiree spending rates: Beyond the 4% rule,” January 2025.

2 EBRI and Greenwald Research, “35th Annual Retirement Confidence Survey,” 2025.

3 Corebridge Financial and the Longevity Project, “Funding longer lives: Preparing Americans for greater financial security and well-being in retirement,” March 2024.

Important Disclosures

Opinions are as of 5/28/2025 and are subject to change.

Investing involves risk including possible loss of principal. Past performance is no guarantee of future results.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Bank of America, Merrill or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

The Chief Investment Office (CIO) provides thought leadership on wealth management, investment strategy and global markets; portfolio management solutions; due diligence; and solutions oversight and data analytics. CIO viewpoints are developed for Bank of America Private Bank, a division of Bank of America, N.A., (“Bank of America”) and Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S” or “Merrill”), a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”).

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Bonds are subject to interest rate, inflation and credit risks. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government.