How a Merrill Lynch Financial Advisor Can Help with Your Financial Goals

Creating a better financial future for women

Our breakthrough study sheds light on the role gender plays in financial advisor-client relationships.

When it comes to serving women, the industry has come a long way, and at Merrill, we’re dedicated to pushing it even further. It's more important than ever that we continue to listen and look for ways to support women investors, especially as the coronavirus pandemic has had a disproportionate effect on women, causing many to have to rethink their goals and priorities.

We commissioned a breakthrough study that examined the financial services industry at large, utilizing cutting-edge technology to understand how gender affects the way financial advisors and investors interact. Here, we’re highlighting some of the most enlightening results that have strengthened our resolve to address gender miscues—unconscious behaviors caused by gender-related stereotypes—in wealth management.

For the full study results, download our white paper, Seeing the Unseen: The Role Gender Plays in Wealth Management

When it comes to finances, women are owning it

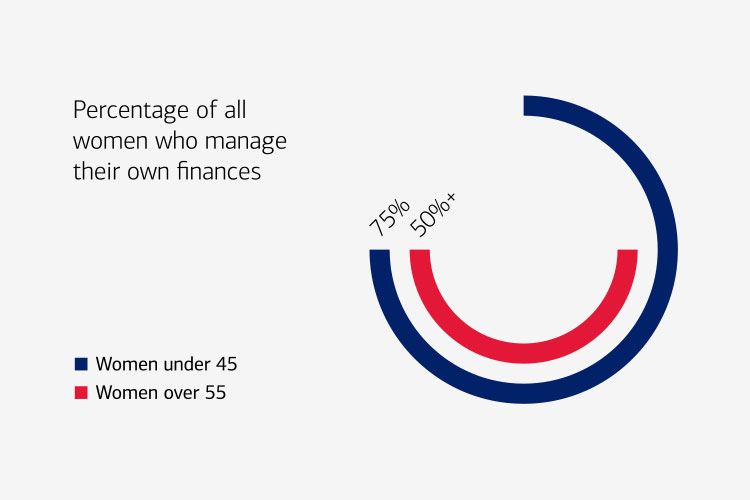

To understand the results of the study, we need to understand how women today are approaching finances. Younger women, especially, are taking charge of their financial lives and expect more from their advisory relationships.

Decision making

- Younger married women are more than twice as likely to say they are the primary decision maker than older married women.

Money management

- More women are coming into marriage with their own money and manage their investments separately from their spouse.

We found some encouraging data

Across the industry, women have told us that they are generally satisfied with their financial advisor relationships, and most do not believe they’ve experienced gender-related stereotyping:

Positive recommendations

- 70% of women are likely to recommend their financial advisor to a friend or relative.

Strong relationships

- 40% of women are likely to follow their financial advisor to another firm (vs. 30% for men).

But the industry still has work to do

Our study did not show signs of conscious bias against women. Yet there are several areas where unconscious behavior may still be negatively affecting women’s experiences. For example, eye-tracking technology showed that, when meeting with heterosexual couples, financial advisors—regardless of gender—tend to focus most of their time (~60%) on the male.

Negative experiences

- 35% of women are likely to switch financial advisors when they have a bad experience (vs. 30% for men).

- Women are more likely than men to expect to encounter gender stereotypes—making them feel they have to prepare more for meetings and speak up proactively to be heard.

Language goes a long way

The language that financial advisors use can affect the way women approach their own finances—including whether they’re willing to take more risk, or make their own investment decisions.

Positive, communal language

- Women financial advisors use positive and communal language significantly more often. This positive language correlates with greater willingness in women investors to make their own investment decisions even if there’s associated risk.

Downside risk words

- Men financial advisors tend to use more downside risk words. This potentially makes women less likely to take risks and more likely to rely heavily on their financial advisors.

We’re committed to progress

At Merrill, we are committed to making the industry even more inclusive and welcoming for everyone. This is especially important today, as women are becoming an increasingly powerful force in the marketplace.

While the expectation of negative experiences can lead to the normalization of gender miscues in some older women investors, the next generation is vastly different. Refusing to accept the status quo, these younger women are taking control of their finances, primarily owning financial decisions for their household, and actively seeking to educate themselves on financial matters. As women's needs evolve, we have an opportunity to exceed their expectations.

Leading the way for a better future

We're taking concrete action to help improve women's experiences. Sharing the results of this study is one step in the journey, as well as:

- Better representing women in our financial advisor training program, which has the most diverse class of financial advisors in our history.

- Cultivating a corporate culture of inclusivity with better awareness of unconscious bias, through inclusion training for all our employees across the country.

- Recognizing the equally important roles both spouses play in a financial relationship by removing the “Primary” designation for account roles.

Financial services providers have a significant role to play in raising the bar and addressing these issues in order to bring about systemic change. By helping the industry move forward, we hope to create a better future for all.

Discover more

To learn more about this study, download our white paper, Seeing the Unseen: The Role Gender Plays In Wealth Management

DownloadTo explore more insights on women and their financial future, visit ml.com/women