1 Social Security Administration, “What is the maximum Social Security retirement benefit payable?” January 2, 2024.

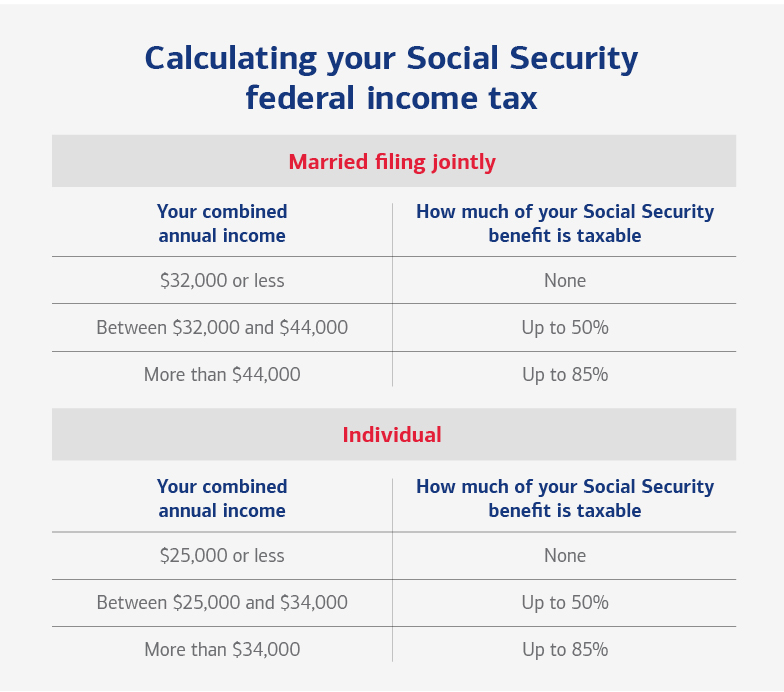

2 Social Security Administration, “Income Taxes and Your Social Security Benefit,” accessed July 8, 2024.

3 Center on Budget and Policy Priorities, “Policy Basics: Top Ten Facts about Social Security,” May 31, 2024.

4 Congressional Budget Office, “CBO’s 2024 Long-Term Projections for Social Security,” August 2024.

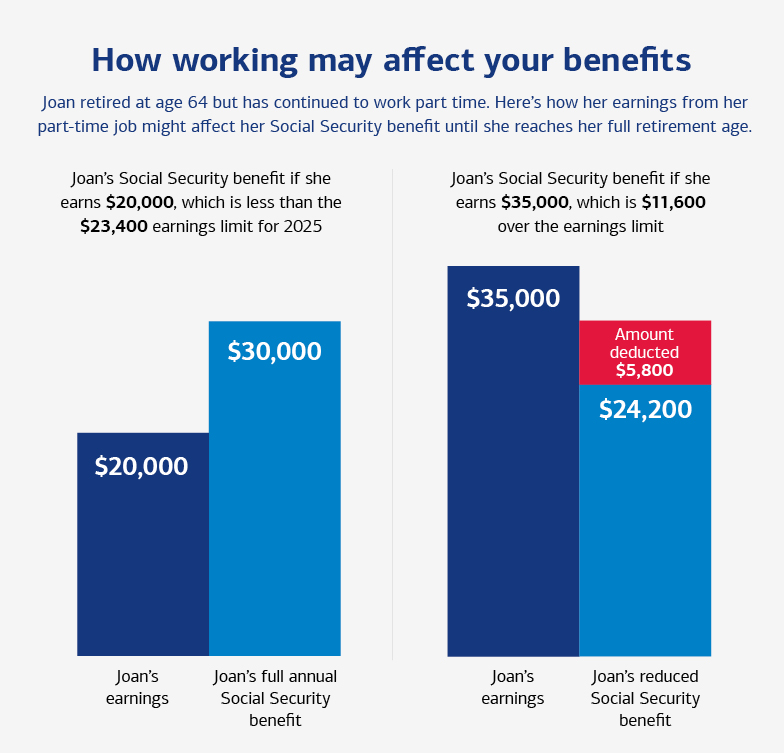

5 Social Security Administration, “Receiving Benefits While Working,” accessed July 8, 2024.

To compute your potential tax liability or the impact of returning to work after retiring early, consult with your tax advisor. As always, your financial advisor can work with your tax professional to find appropriate solutions.

This material should be regarded as educational information on Social Security considerations and is not intended to provide specific advice. If you have questions regarding your particular situation, you should contact the Social Security Administration and/or your legal advisors.

Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.