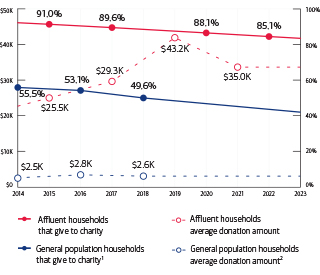

Affluent households gave to charity as follows: 91% in 2015, 89.6% in 2017, 88.1% in 2020, and 85.1% in 2022. General households gave to charity as follows: 55.5% in 2014, 53.1% in 2016, 49.6% in 2018.1 Average donation amounts for affluent households are as follows: $25.5K in 2015, $29.3K in 2017, $43.2K in 2019 and $35.0K in 2021. Average donation amounts for general households are as follows: $2.5K in 2014, $2.8K in 2016 and $2.6K in 2018.2

1 Indiana University Lilly Family School of Philanthropy, Philanthropy Panel Study (PPS)

2 Indiana University Lilly Family School of Philanthropy, Philanthropy Panel Study (PPS)

3 Answers have been abbreviated; full text is available upon request.

4 Answers have been abbreviated; full text is available upon request.

This publication is designed to provide general information about ideas and strategies. It is for discussion purposes only since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Always consult with your independent attorney, tax advisor, investment manager and insurance agent for the final recommendations and before changing or implementing any financial, tax, or estate planning strategy.

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Clients should consult their legal and/or tax advisors before making any financial decisions.

Donor-advised fund and private foundation management are provided by Bank of America Private Bank, a division of Bank of America N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation.

Institutional Investments & Philanthropic Solutions (also referred to as Philanthropic Solutions” or “II&PS”) is part of Bank of America Private Bank, a division of Bank of America, N.A., Member FDIC and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”). Trust, fiduciary, and investment management services are provided by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A. and its agents. Brokerage services may be performed by wholly owned brokerage affiliates of BofA Corp., including Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”).

MLPF&S makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of BofA Corp. MLPF&S is a registered brokerdealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of BofA Corp.