As you make decisions in all areas of your financial life, an advisor can offer personalized guidance on how to avoid common pitfalls and reach your goals

Key takeaways:

THE UNNERVING UPS AND DOWNS OF THE STOCK MARKET. The prospect of inflation undermining your buying power. Higher interest rates boosting the cost of borrowing. The financial world can be a daunting place. And even in the most placid of economic times, you face a confusing welter of rules and decisions surrounding retirement accounts, asset allocation, your retirement age and Social Security claiming strategies.1 Imagine, then, having a trusted ally who has seen what you’re going through many times before and has years of experience helping others like you navigate the choices that come with a complicated landscape. In other words, a financial advisor.

But if you’ve never worked with a financial advisor, you may wonder what they can really do for you, what the relationship is like, what financial decisions they can help with and how you know you’ve found the right match. Here’s what to expect.

Often the decision to consult with an advisor is triggered by a life change, such as buying a home, inheriting money or starting a family. A good advisor always starts by identifying your goals — even your hopes and dreams — and then turns that understanding into a personalized financial strategy that can help you make those dreams come true.

Ready to work with a dedicated advisor in your area? Fill out the form below.

Answer a couple of questions about yourself to see advisors who match your preferences.

Then, choose who you’d like to connect with.

Are you trying to connect to your advisor?

Look up their contact information here. Or try our Contact us page.

If you’re interested in building your own portfolio with a wide range of investment choices, Merrill Edge® Self Directed may work for you.

![The times in your life when you may need an advisor. Inheriting money. Ask an advisor: What are the rules for an inherited IRA? Should I invest my inheritance or use it to pay off my mortgage?]](/content/dam/ML/Articles/images/what-can-an-advisor-really-do-for-me/2708W_Merrill_Recomply_TheValueofAdvice_Slide4_062124_F360_784x750.jpg)

A conversation about your goals should cover all your priorities — your family, your career, where you may want to live in the future, how much travel you’re longing to do and what your giving goals are. It may even uncover some goals (starting a business or learning to fly?) that you didn’t realize you had.

This upfront talk will also take into consideration where you are in your life: Are you nearing retirement and looking to relocate or just starting a family and anticipating college costs? Will your parents need eldercare in the future? Have you just become a grandparent? If so, do you have a will and inheritance plan in place?

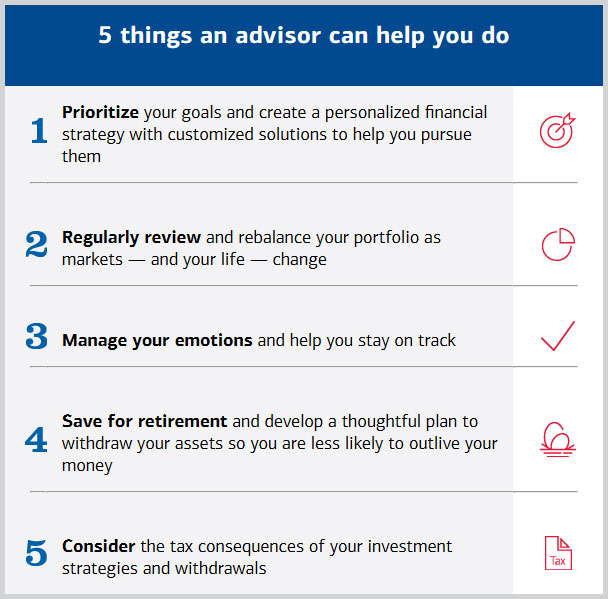

Once you’ve discussed all of that, you and your advisor can work together to identify and prioritize your goals. Only then will you talk about what sort of investments and financial strategies might help you meet them. “Then, as you reach life’s major turning points, you’ll want to keep checking in,” says Valerie Galinskaya, managing director and head of the Merrill Center for Family Wealth®. “As your life changes, your priorities will change too, and your advisor should be able to help you make important financial decisions every step of the way.”

“The financial strategy your advisor will help you create is like a personal financial road map you can follow and adapt to pursue your goals.”

No two people will have the same set of investment strategies or solutions. Depending on your goals, your tolerance for risk and the time you have to pursue those goals, your advisor can help you identify a mix of investments that are appropriate for you and designed to help you reach them.

But the decisions don’t stop there. An advisor can walk you through many complex financial choices. What if you inherit your parents’ home? Is it smarter to sell it and invest the proceeds or rent it out for income? As you approach retirement, you’ll be faced with important decisions about how long to work, when to claim Social Security, what order to withdraw money from your various accounts and how to balance your need for income with making sure your money lasts you for the rest of your life.

In fact, there are so many financial decisions to be made at every stage of life that, at some point, people often begin to wonder whether they might benefit from working with someone who has experience and access to a broad range of resources, in mortgage lending, for instance, or trust creation. Someone who can help them make sense of it all.

“Your advisor is best used as a partner who has the experience to help you navigate the opportunities and challenges of your financial life. The financial strategy your advisor will help you create is like a personal financial road map you can follow and adapt to pursue your goals,” says Galinskaya.

Once you’ve worked with your advisor to create a strategy that makes sense for you, you’ll meet periodically to make any needed adjustments based on market activity or changes in your life and the goals you’ve set for yourself. “Along the way, they can play an important role by helping to provide the objectivity you need to make more effective financial decisions,” says Galinskaya.

That objectivity can help you avoid the kinds of problems you might get yourself into over time, like gradually taking on more investment risk than you can tolerate, buying a larger home than you can truly afford or setting too high a withdrawal rate once you retire. When markets drop or behave in unpredictable and unsettling ways, an advisor can be a valuable sounding board. By reminding you of your goals and the risk tolerance considerations you built into your investment strategy, they can help you stick to your plan or discuss potential adjustments that might be appropriate. By providing historical data that could remind you of the way markets have performed over the long term, they can help you keep your perspective.

“Financial advisors can be of great help if they will do the following two things,” says Dan Ariely, professor of psychology and behavioral economics at Duke University. “First, they can help us fight against our nature when the stock market goes wild,” he says. “And the second thing is that they can help us figure out how to spend our money more wisely — what to consider buying and what not to buy in order to maximize our quality of life.”

“Financial advisors can help us fight against our nature when the stock market goes wild, and they can help us figure out how to spend our money more wisely.”

Revealing your most intimate money profile to a stranger can make you feel vulnerable. So while your advisor doesn’t have to be your emotional confidant, they do have to be someone you trust and feel comfortable talking to face to face. And if you’re married, that applies to both of you.

“It’s important to get a feel for whether they will take a goals-based wealth management approach to your strategies rather than just focusing on investments and what the markets are doing,” says Galinskaya. “It’s also critical to get a handle on how deep the advisor’s experience is in serving clients with a similar degree of wealth,” she adds. Other topics to consider: the range of offerings, such as investments, philanthropy, trust services, insurance, mortgages and other lending solutions, that the advisor and the broader firm can provide.

At its best, a relationship with a financial advisor should focus on your best interest and keep you informed so you’re on the right path financially and can concentrate on the things you’re investing for — your passions in life, your priorities, your family.

Work one-on-one with a Merrill advisor for more insights and personalized guidance. Connect with us today.

1 This material should be regarded as educational information on Social Security considerations and is not intended to provide specific advice. If you have questions regarding your particular situation, you should contact the Social Security Administration and/or your legal and/or tax advisors.

2 The Merrill Lynch Investment Advisory Program is an investment advisory program sponsored by Merrill. Merrill offers a broad range of brokerage, investment advisory and other services. There are important differences between brokerage and investment advisory services, including the type of advice and assistance provided, the fees charged, and the rights and obligations of the parties. It is important to understand the differences, particularly when determining which service or services to select. All recommendations must be considered in the context of an individual investor’s goals, time horizon, liquidity needs and risk tolerance. Not all recommendations will be in the best interest of all investors. For more information about the Merrill Lynch Investment Advisory Program, including our fiduciary responsibilities, you may obtain a copy of the Merrill Lynch Investment Advisory Program Brochure by accessing the SEC website at www.adviserinfo.sec.gov.

Timely insights to stay ahead of the curve